|

It's finally the season when everything springs into action again — including you. Now’s the time to roll up your sleeves and take care of the things you’ve neglected during the winter months. You’ll want to make sure your home is ready for September showers and the impending summer weather.

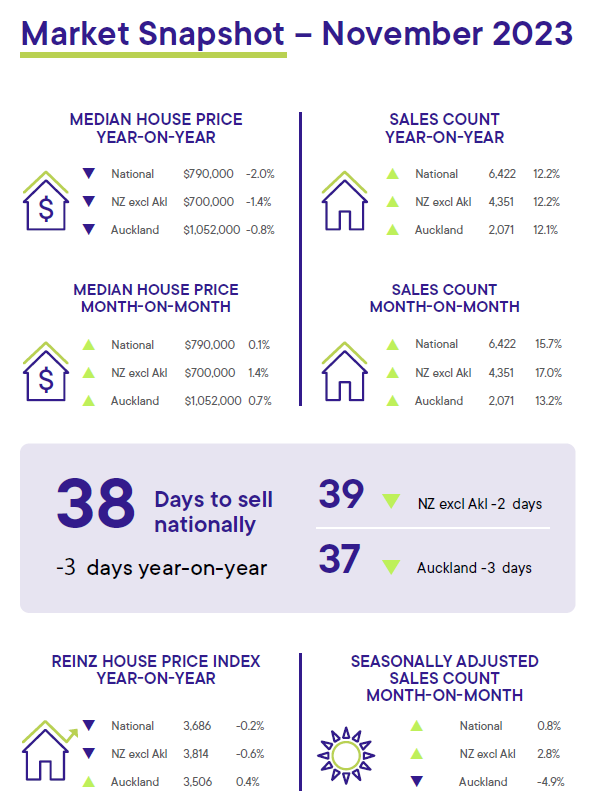

Spring cleaning is a good place to start, but the turn of the season also presents an opportunity to be more thorough with your home maintenance. Here are 10 things you need to do, inside and out, to prep your home for spring. EXTERIOR SPRING HOME MAINTENANCE 1. Take a Look at the Roof Even if your roof didn't take a beating from snow and rain conditions, spring is still a great time to give it a once-over. Safety first: If you're using a ladder, make sure it's stable before you attempt to climb. Look for missing or damaged shingles and signs of leaking or cracking. Contact a professional in case of any issues. You may also consider removing stains on your roof during spring. If you notice any dark streaks, algae are the likely culprit. The only harm, in that case, is cosmetic. If you notice moss, on the other hand, you should definitely clean it. Moss can cause asphalt shingles to lift, concrete tiles to crack and Longrun iron roofs to discolor. 2. Clean the Gutters Clean all debris and leaves out of the downspouts and gutters. Reattach the gutters if they are sagging or consider replacing them if they are beyond repair. Notice any holes? Prevent leaks by caulking them with silicon. Keep in mind that downspouts should face away from your home to improve drainage or be plumbed into the house's stormwater system. 3. Give Your Heatpump Some Attention Remove debris from around the unit, replace filters, and clean ducts and vents. If your filters are clogged, air can't easily pass through and your unit must work harder to cool your home. Clogged filters can lead to lower air quality in your home. Don't skip this step; you may be able to lower your energy consumption by up to 15%. You can also schedule a professional tune-up. An expert Heatpump technician can check your system's efficiency, check coolant levels and address any issues before the summer heat arrives. 4. Spruce Up Your Lawn and Landscaping Trim any overgrowth and clear your landscaping. Spring is also the best time to tidy up flowerbeds and give them a good facelift. You can also use dead organic matter from the compost pile as fertilizer. Add a layer of gravel on top of the soil to suppress weeds. Make sure to use compacted soil in low areas of your yard as rain can cause foundation damage and flooding. Tend to your lawn now to ensure lush green grass during summer. Start by raking the lawn deeply to get rid of thatch and dead grass. This will also allow fertilizer and seed to penetrate easily. After cultivating, ensure that the lawn is firmed and ready for sowing. Try a shade-tolerance seed mix if your yard has a lot of tree cover or use a hard-wearing mix if your lawn gets a lot of traffic in the summer. Bald patches should be overseeded. Apply nitrogen fertiliser to give your grass a boost. If you plan on growing vegetables, prepare the beds by getting rid of weeds and forking in garden compost. Cover the beds with plastic sheets to keep the soil warm until you are ready to sow the plants. 5. Inspect the Concrete Take a walk around your home and check for cracking along the driveway, pool deck, or walkways. Fill cracks using silicone caulk or concrete fillers. If concrete cracks are beyond this simple fix, consider replacing the concrete altogether. 6. Check Out the Deck When inspecting your deck, look for water stains, warping or discoloration. Watch out for loose or rusty nails and perform any necessary maintenance to secure stairs and railings. If you find lifting or rotting boards, replace them. If your deck is faded or covered in a dark algae then consider getting a professional in to clean and restore the deck, A simple clean will have your deck looking as good as new again and will have it ready for you to stain and or re-oil the timer deck. 7. Run the Sprinklers Give your sprinklers a test run. Keep an eye out for leaks and malfunctioning sprinkler heads. Make sure the sprinklers are watering your grass and not decks, patios, or sidewalks. 8. Inspect Windows and Doors Fix or replace the screens on windows and doors to keep bugs from entering your home. This is also a good time to wash your windows. Clean the tracts and seals with a vacuum attachment or a soft brush before you start washing the panes. Don't forget to clean the weep holes on storm windows. Test that these essential drain holes are open by pouring some water into the sill. You can also use a thin wire to clear out the holes. Finally, check for tall grasses or stagnant water near your windows. Stagnant water can be a breeding ground for mosquitoes. 9. Repair and Reseal Woodwork Rails, fences, trellises, and other wood features need some love, too. These structures are prone to decay and rot if left alone. If you have wooden fences, repair any damage to the panels. Split or broken pieces can be glued back together if the wood is dry. Support the pieces with tape as the glue sets. Replace planks that are too damaged for repair. Use a pressure washer to revitalise tired wood, then use wood oils and wood preserves to protect it. Decking oil is the best for fence treatment because it keeps the wood supple and water-resistant. Exterior wood oil helps preserve your wood and can prolong the life of your fence. 10. Spray For Pests & Bugs Spring is the time you want to get a professional in to spray your house for pests and bugs, Spring is the time of plenty and this Is the same for pests and bugs, from wasps, cockroaches, ants, and more. So have your house and property fumigated before the problem gets out of control.  The Real Estate Institute of New Zealand's (REINZ) April 2023 figures show the continuing challenge of the economic climate has put further pressure on market pace. REINZ Chief Executive Jen Baird says April tends to be slow due to public and school holidays, and it's clear those factors combined with a tight economy are still influencing the market. "Overall, median prices have decreased across New Zealand but are moderating, sales counts have eased annually, and inventory levels have stabilised," adds Baird. Read full REINZ Monthly Report here Read REINZ House Price Index Report here Trademe have just released their annual "State of the Nation Report. This report looks at Kiwi online search behaviour and discusses emerging trends across the property, jobs and car market sectors, plus the potential implications on business.

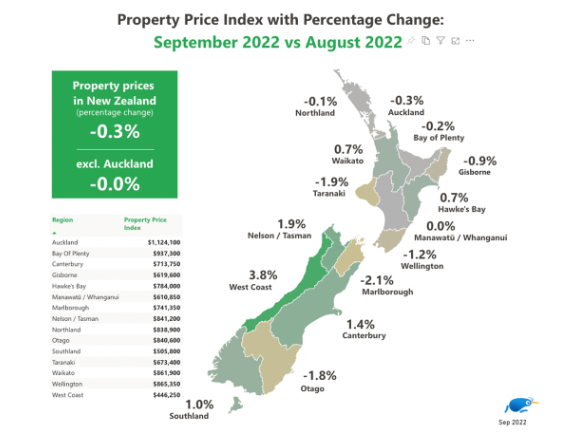

Check it out! The national average asking price for a property has dropped for six consecutive months for the first time on record, according to the latest Trade Me Property Price Index.

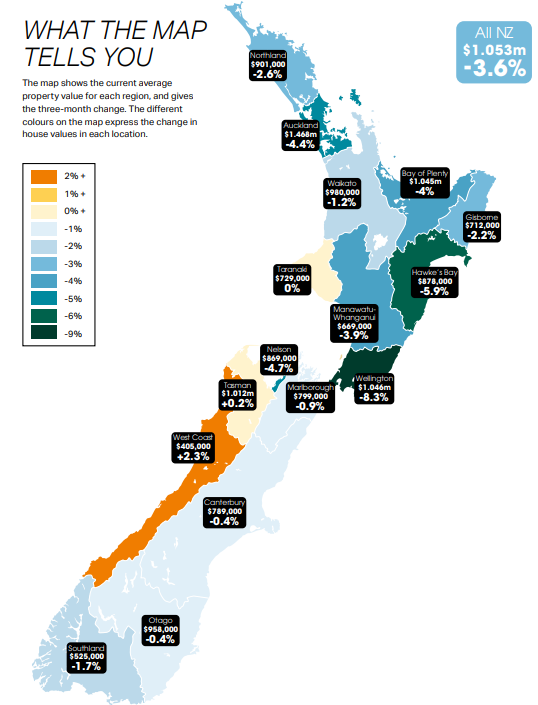

In September, Trade Me Property Sales Director Gavin Lloyd said the national average asking price was $896,200. “When compared with the month prior, this marks a drop of $3,000 and puts New Zealand’s average property price at its lowest since October 2021.” Read Trademe's Property Pulse Report here. The housing market slump shows no signs of easing, with the nationwide average property value dropping 3.6% in the last three months. Auckland's average property value was down a relatively modest 4.4% over the three months to the end of July - it's fifth successive quarterly decline since end of March - and is up just 5.1% year on year. Could now be the time to buy?

Read report here Each month Tony Alexander prepares a document called Regional Property Insights in which he looks at developments in residential property markets for each region around New Zealand. This month Tony looks at price trends for many of each region's local authority areas to highlight the differences which can exist within a region.

Load Tony Alexander's Report The house price gains of 2021 are in danger of being wiped out, with the latest figures from the OneRoof-Valocity House Value Index pointing to the steady erosion of property values across much of the country.

The nationwide average property value fell 2.9% in the last three months to $1.064 million - $21,000 below where it was at the start of the year. Read report here Property values are tumbling across the country, with house prices in most of New Zealand's major cities suffering sharp falls. The latest figures from OneRoof-Valocity House Value Index show steep declines in Auckland, Dunedin, Hamilton, Tauranga and Wellington.

Read report REINZ December sales data rounds off a strong year in the New Zealand property market, with price and activity holding strong and steady.

Read report Dubbed 'the year of property politics', 2021 has given us plenty to talk about.

From sharply rising property prices, to increasing mortgage and cash rates, and a seemingly constant stream of regulatory pressures and government interventions, 2021 has had it all. CoreLogic NZ has just released the Best of the Best 2021 report; the most comprehensive analysis of residential property in the country. So which suburbs were the country's top performers? And what's on the horizon for 2022? Tis soon to be the season of giving and cheer, a Little Ray of Giving is back for the 10th year.

This drive supports the Ronald McDonald House of Charities Organisation and is a great chance to give to families with a child in hospital. This year we are accepting donations from the 23rd November - 14th December at all of our Ray White Eastern Group offices. Every week, families arrive at hospitals away from their homes with a child in need of urgent medical treatment. Please donate today to provide accommodation, food and support to families with a child in hospital."- Ronald McDonald House Charities NZ Details of how to donate gifts and participate in this charity drive can be found on Ray White Eastern Group's social media pages. The Ray White Eastern Group would like to thank you in advance for your support. |

Archives

February 2024

Categories

All

|

Location12 Uxbridge Road, Howick, Auckland

(Team Anton office is next to the Ray White Howick office) Five AM Realty Ltd, Licensed (REAA 2008) |

|

|

RSS Feed

RSS Feed